Nifty opened positive but dipped below the previous day’s close within the first few minutes of trade, where the responsive buyers took control to move the index above 6300 level and then stayed in a very narrow range to close at 6304.00, a small gain of 12.90 points. The broader market was positive, with 825 advances to 561 declines. Range for the week stays around 6250-6400.

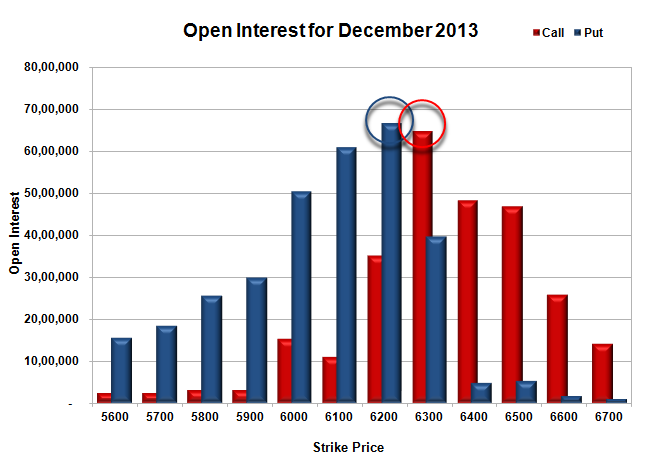

- Call option 6400-6700 added 1.42 lacs huge amount of OI with small profit booking seen at 6800 strike price.

- Put option 6400-6200 added 5.38 lacs huge amount of OI with small profit booking seen at 6000 strike price.

- Nifty Open Interest is at 1,97,38,300 up by 4,94,950, with increase in price, most probably huge long build-up.

- Bank Nifty Open Interest is at 14,24,850 up by 30,225, with increase in price, most probably huge long build-up.

- FII’s bought small 0.25 lacs Futures, mostly long build-up, as their net OI increased by 9951 contracts (includes 21143 longs and 20640 shorts for the day) and the average price per contract comes to around 6308.86.

- FII’s future open contract as on date is 437017.

- PCR Open Interest (Volume) is still below 1 at 0.918.

- Initial and best support at 6300, with huge OI of 37.97 lacs and below that at 6200 with huge OI of 35.62 lacs.

- Initial resistance at 6400, with huge OI of 35.36 lacs and above that at 6500, with highest OI of 43.99 lacs.

- Day Range as per Option Table is 6251 - 6348 and as per VIX is 6254 - 6354 with 6303 as the Pivot.

Buy Nifty 6400CE above 82 for targets of 88, 97 SL - 77

Buy Nifty 6300PE above 80 for targets of 87, 95 SL - 76

India VIX : 15.12, up by 0.04 points

Call OI : 26236850

Put OI : 24086000

PCR OI : 0.918

SMR : 16.47 (Bullish with Caution: Nifty gave highest Yearly and Monthly close of all time and set the platform for new all time high in New Year but only roadblock is PCR still below 1...)