Nifty opened positive on the back of good global cues, and gained strength with each passing hour with huge long build-up to close around the highs of the day at 5842.20, a huge gain of 159.85 points. On a week-on-week basis the index gained 174.55 points or approx 3.08%. The broader market was also very good, with 974 advances to 337 declines. Option Table saw huge support building up around 5700 level with highest addition for the day at 16.84 lacs.

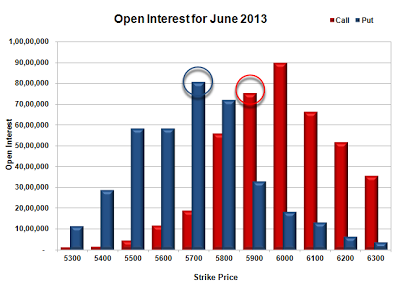

- Call option 5900-6100 added 21.42 lacs huge amount of OI with short covering seen at 5800 and lower prices.

- Put option 6000-5500 added 42.37 lacs huge amount of OI with some addition seen at 5300 level.

- Highest accumulation on Call option 6000 at 42.59 lacs & 5900 at 40.51 lacs whereas Put option 5600 at 60.02 lacs & 5700 at 47.88 lacs.

- Nifty Open Interest is at 1,43,32,450 up by 24,16,000, with increase in price, most probably long build-up.

- Bank Nifty Open Interest is at 11,65,400, down by 7,375, with increase in price, most probably small short covering.

- FII’s bought huge 29.23 lacs Futures, most probably long build-up, as their net OI increased by 61026 contracts and the average price per contract comes to around 5839.60.

- FII’s future open contract as on date is 316223.

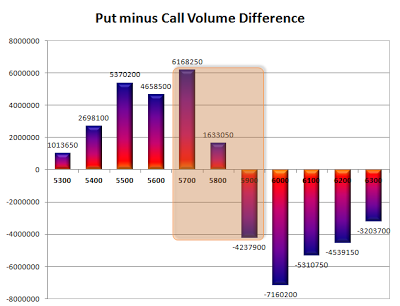

- PCR Open Interest (Volume) has gathered momentum and is now at 1.374.

- Initial support at 5800, with huge addition for the day at 16.84 lacs and below that at 5700 with huge OI of 47.88 lacs.

- Initial resistance at 5900, with huge OI of 40.51 lacs and above that at 6000 with OI of 42.59 lacs.

- Range as per Option Table is 5748 - 5895 and as per VIX is 5787 - 5897 with 5820 as the Pivot.

Buy Nifty 5800CE above 124 for targets of 141, 159 SL - 111

Buy Nifty 5800PE above 99 for targets of 115, 143 SL - 91

India VIX : 17.95 down by 0.90 points

Call OI : 25157900

Put OI : 34571750

PCR OI : 1.374

SMR : 13.06 (Bullish: On the first day of the new series, the Bulls made it clear that they are going to dominate this expiry, will the Bears sit back and relax, and well next week can provide the answers...)