The index opened flat and stayed in a narrow till RBI policy came out, which saw no change, but the index zoomed up to the highs of the day at 8031. Profit booking saw the index close flat at 7964.80, a miniscule gain of 5.90 points. The broader market though was negative, with 713 advances to 812 declines. The initial series range still remains at 7800-8200.

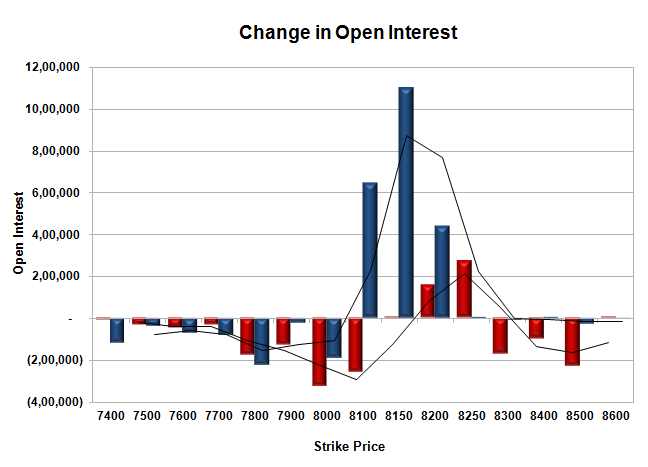

- Call option 8000-8400 added huge 17.24 lacs OI with profit booking seen at 8500 strike price.

- Put option 8000-7500 added huge 39.76 lacs OI with short covering seen at 8100 and above strike prices.

- Nifty Open Interest is at 1,57,01,650 up by 1,97,800, with no change in price, probably long build-up.

- Bank Nifty Open Interest is at 14,79,750 down by 60,200, with decrease in price, probably long liquidation.

- FII’s bought 2.90 lacs Futures, which includes 8534 contracts long build-up and 2740 contracts short build-up, with increase in net OI by 11274 contracts (includes 50774 longs to 44980 shorts for the day) and the average price per contract comes to around 7965.76.

- FII’s Index future open contract as on date is 213404 Longs to 64091 Shorts, net long 149313 contracts.

- Initial and super support at 7900, with OI of 52.57 lacs and below that at 7800 with highest OI of 55.61 lacs.

- Initial resistance at 8100, with huge OI of 45.99 lacs and above that at 8200 with huge OI of 54.79 lacs.

- Day Range as per Option Table is 7899 - 8047 and as per VIX is 7910 - 8020 with 7973 as the Pivot.

Buy Nifty 8100CE above 73 for targets of 89, 114 SL - 67

Buy Nifty 8000PE above 113 for targets of 138, 164 SL - 107

India VIX : 13.15 down by 0.24 points

Call OI : 31346250

Put OI : 34436650

PCR OI : 1.099

SMR : 11.97 (Neutral: The index closed flat, but the PE writers took to opportunity to add huge ad 8000-7700 level, based on it, downside for the time being seems limited, a close above 7975 NS will confirm the same...)