Inference

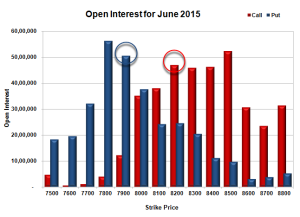

The Index opened flat and stayed in a narrow range for the better part of the day. Short covering towards the end saw the index spurt upwards to close near the highs of the day at 8368.50, gain of 50.10 points. The broader market was strong, with 1054 advances to 440 declines. The OI table range is at 8000-8500.

Call OI : 26079800

Put OI : 36283425

PCR OI : 1.391

SMR : 12.17 (Bullish : The OI Table strength continues with support starting from 8300 level, resistance of note only around 8400-8500, Buy on Dips is back...)

The Index opened flat and stayed in a narrow range for the better part of the day. Short covering towards the end saw the index spurt upwards to close near the highs of the day at 8368.50, gain of 50.10 points. The broader market was strong, with 1054 advances to 440 declines. The OI table range is at 8000-8500.

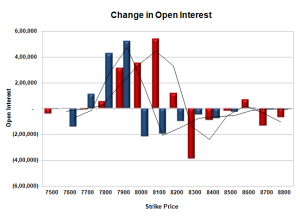

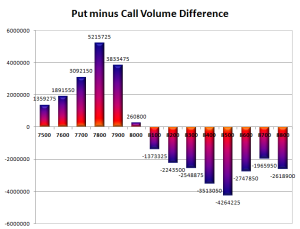

- Call option 8300-9000 added huge 15.65 lacs OI with short covering seen at 8200 and below strike prices.

- Put option 8400-8000 added huge 12.90 lacs OI with profit booking seen at 7900 strike price.

- Nifty Open Interest is at 1,63,29,550 up by 11,28,925, with increase in price, most probably huge long build-up.

- Bank Nifty Open Interest is at 15,13,575 up by 24,375, with increase in price, most probably long build-up.

- FII’s bought 4.24 lacs Futures, which includes 33673 contracts long build-up and 16720 contracts short build-up, with increase in net OI by 50393 contracts (includes 71679 longs to 54726 shorts for the day) and the Average Price comes to 8537.59.

- FII’s Index future open contract as on date is 456168 Longs to 156234 Shorts, Net Long 299934 contracts.

- Initial support at 8300, with OI of 29.22 lacs and below that at 8200 with OI of 33.86 lacs.

- Initial resistance still at 8400, with OI of 30.29 lacs and above that at 8500 with OI of 34.85 lacs.

- Day Range as per Option Table is 8278 - 8428 and as per VIX is 8294 - 8443 with 8348 as the Pivot.

Call OI : 26079800

Put OI : 36283425

PCR OI : 1.391

SMR : 12.17 (Bullish : The OI Table strength continues with support starting from 8300 level, resistance of note only around 8400-8500, Buy on Dips is back...)