Nifty opened up around 6270 level but saw small profit booking towards the lows at 6240, but weekend short covering rally saw the index move towards 6280 but closed just below at 6276.95, a gain of 38.15 points. On a week on week basis the index gained 121.50 points of approx 1.97%. The broader market was just positive, with 734 advances to 719 declines. Developing range for the Series is around 6000-6400.

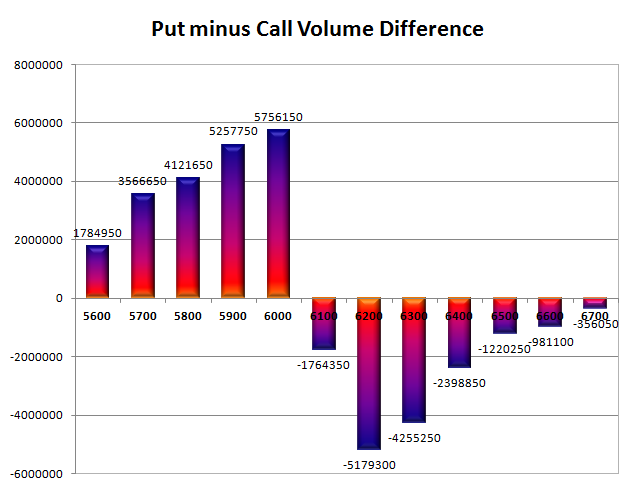

- Call option 6300-6800 added 32.45 lacs huge amount of OI with small short covering seen at 6200 and lower strike prices.

- Put option 6300-5700 added 30.68 lacs huge amount of OI with not much change in other strike prices.

- Nifty Open Interest is at 1,37,05,450 up by 98,300, with increase in price, most probably small long build-up.

- Bank Nifty Open Interest is at 15,46,650 up by 65,300, with increase in price, most probably huge long build-up.

- FII’s sold huge 2.07 lacs Futures, mostly short build-up, as their net OI increased by 56 contracts (includes 75514 longs and 79654 shorts for the day) and the average price per contract comes to around 6168.84.

- FII’s future open contract as on date is 293714.

- PCR Open Interest (Volume) has decrease a bit to 1.098.

- Initial support at 6200, with huge OI of 44.57 lacs and below that at 6100 with highest OI of 45.30 lacs.

- Initial and best resistance still at 6300, with huge OI of 44.42 lacs and above that at 6400, with OI of 39.79 lacs.

- Day Range as per Option Table is 6220 - 6308 and as per VIX is 6230 - 6324 with 6263 as the Pivot.

Buy Nifty 6300CE above 78 for targets of 87, 97 SL - 73

Buy Nifty 6300PE above 95 for targets of 102, 114 SL - 89

India VIX : 14.18 up by 0.22 points

Call OI : 25409000

Put OI : 27897100

PCR OI : 1.098

SMR : 12.92 (Bullish: Bulls are very much in control of the situation but need a strong move above 6300 for a new all time high or else may see corrective towards 6100...)