Inference

Nifty opened negative on settlement day, and stayed in a range of 20 points for the better part of the session, but huge short covering in the dying minutes saw the index cross 6300 for the first time after 3 years but closed just below it at 6299.15, a huge gain of 47.45 points. The broader market was positive, with 737 advances to 600 declines. OI table at the start of the series is building up support around 6000 level.

Buy Nifty 6300CE above 133 for targets of 144, 155 SL - 126

Buy Nifty 6300PE above 115 for targets of 127, 149 SL - 109

India VIX : 18.39 down by 1.14 points

Call OI : 19839000

Put OI : 23547200

PCR OI : 1.187

SMR : 15.49 (Bullish: As said yesterday, a new high for year and an all time highest monthly closing was seen today, but the November series OI is not super bullish, so longs need to cautious at higher levels...)

Nifty opened negative on settlement day, and stayed in a range of 20 points for the better part of the session, but huge short covering in the dying minutes saw the index cross 6300 for the first time after 3 years but closed just below it at 6299.15, a huge gain of 47.45 points. The broader market was positive, with 737 advances to 600 declines. OI table at the start of the series is building up support around 6000 level.

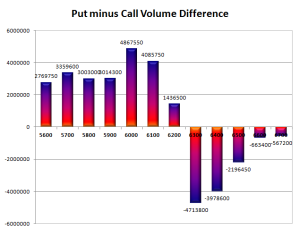

- Call option 5600-6700 added 44.32 lacs huge amount of OI.

- Put option 6600-5600 added 50.31 lacs huge amount of OI.

- Nifty Open Interest is at 2,30,29,900 up by 41,77,600, with increase in price, most probably huge long build-up.

- Bank Nifty Open Interest is at 17,35,950 up by 4,92,725, with increase in price, most probably huge long build-up.

- FII’s bought huge 7.71 lacs Futures, mostly short covering, as their net OI decreased by 167031 contracts (includes 239956 longs and 224538 shorts) and the average price per contract comes to around 6269.94.

- FII’s future open contract as on date is 502227.

- PCR Open Interest (Volume) at start of series is just at 1.187.

- Initial Support right now at 6200, with huge OI of 28.89 lacs, below that at 6100, with OI of 27.76 lacs.

- Best Resistance at 6300, with OI of 27.56 lacs and above that at 6400, with OI of 25.47 lacs.

- Day Range as per Option Table is 6224 - 6347 and as per VIX is 6239 - 6360 with 6281 as the Pivot.

Buy Nifty 6300CE above 133 for targets of 144, 155 SL - 126

Buy Nifty 6300PE above 115 for targets of 127, 149 SL - 109

India VIX : 18.39 down by 1.14 points

Call OI : 19839000

Put OI : 23547200

PCR OI : 1.187

SMR : 15.49 (Bullish: As said yesterday, a new high for year and an all time highest monthly closing was seen today, but the November series OI is not super bullish, so longs need to cautious at higher levels...)