Inference

Nifty opened big and rallied sharply on the optimism of the European leaders will take action of the Euro problem and our Prime Minister also taking charge of Finance Ministry. The index saw one of its biggest gains after 4 dull days of trading to close at 5278.90, a gain of 129.75 points and weekly gain of 132.85 points or 2.58%. The Option Table saw huge makeover with 5200PE adding a whopping 22 lacs and 5400CE adding 18.5 lacs, with the range shifting to 5200-5400 for the coming week. Nifty saw huge addition 35.5 lacs OI and now today’s low becomes very important.

Buy Nifty 5300CE above 98 for targets of 116, 134 SL - 85

Buy Nifty 5200PE above 74 for targets of 89, 117 SL - 71

India VIX : 19.08 down by 1.54 points

Call OI : 27781650

Put OI : 42384700

PCR OI : 1.526

SMR : 12.51 (Bullish : June range has been broken on the upside with huge OI addition, now Bears need to do all the work...)

Nifty opened big and rallied sharply on the optimism of the European leaders will take action of the Euro problem and our Prime Minister also taking charge of Finance Ministry. The index saw one of its biggest gains after 4 dull days of trading to close at 5278.90, a gain of 129.75 points and weekly gain of 132.85 points or 2.58%. The Option Table saw huge makeover with 5200PE adding a whopping 22 lacs and 5400CE adding 18.5 lacs, with the range shifting to 5200-5400 for the coming week. Nifty saw huge addition 35.5 lacs OI and now today’s low becomes very important.

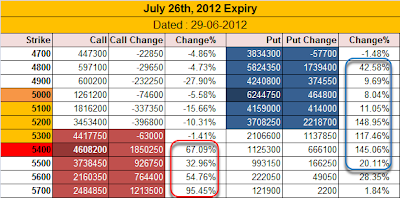

- Call option 54000-5700 added 47.5 lacs huge amount of OI, with huge liquidation seen at 5200 and lower levels.

- Put Option 5500-4800 added 71.8 lacs huge amount of OI, with small profit booking seen at 4700 level.

- Highest accumulation on Call option 5400 at 46.1 lacs & 5300 at 44.2 lacs whereas Put option 5000 at 62.4 lacs & 5100 at 41.6 lacs.

- Nifty Open Interest is at 2,16,38,200 up by 35,55,150 with huge-huge increase in price, most probably huge long build-up.

- Bank Nifty Open Interest is at 25,06,475 up by 15,150 with huge increase in price, most probably some long build-up.

- FII’s bought huge 32.64 lacs Futures, most probably long build-up, their OI also increased by 26.9 lacs, and their average price per contract comes to around 5185.

- FII’s future open contract as on date is 4.86 lacs.

- PCR Open Interest (Volume) has started gaining momentum on the upside and now at 1.526.

- Support has jumped up to 5200, with huge addition of 22.2 lacs, below that at 5000 with highest OI of 62.4 lacs.

- Resistance is right now placed at 5300 but look vulnerable, with OI of 44.2 lacs and above that at 5400 with highest OI of 46.1 lacs.

- Range as per Option Table is 5195 -5310 and as per VIX is 5216 - 5321 with 5250 as the Pivot.

Buy Nifty 5300CE above 98 for targets of 116, 134 SL - 85

Buy Nifty 5200PE above 74 for targets of 89, 117 SL - 71

India VIX : 19.08 down by 1.54 points

Call OI : 27781650

Put OI : 42384700

PCR OI : 1.526

SMR : 12.51 (Bullish : June range has been broken on the upside with huge OI addition, now Bears need to do all the work...)