The index opened positive and went on to touch 8800, but saw huge sell-off to close weak at 8591.25, huge loss of 153.90 points. The broader market was weak with 126 advances to 1532 declines. Range at the start of series 8400-9000.

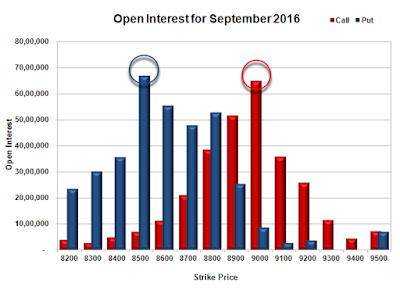

- Call option 8000-9300 added huge 55.46 lacs OI.

- Put option 8600-8000 added 52.53 lacs OI with short covering at 8700 and above strike prices.

- Nifty Open Interest is at 2,38,23,600 up by 60,34,575 with decrease in price, 100% roll-over with huge short build-up.

- Bank Nifty Open Interest is at 18,78,000 up by 7,75,200 with decrease in price, 100% roll-over with huge short build-up.

- FII’s bought 13804 contracts of Index Futures, which includes net 154523 contracts long liquidation and 56871 contracts short covering, with decrease in net OI by 211394 contracts, includes 152766 longs to 138962 shorts for the day.

- FII’s Index future open contract as on date is 245091 Longs to 34363 Shorts, Net long 210728 contracts.

- Initial support at 8600, with OI of 29.72 lacs and below that at 8500 with OI of 29.54 lacs.

- Initial resistance at 8700, with OI of 16.92 lacs and above that at 8800 with OI of 24.31 lacs.

- Day Range as per Option Table is 8561 - 8717 and as per VIX is 8508 - 8674 with 8650 as the Pivot.

Call OI : 27525675

Put OI : 27122475

PCR OI : 0.9854

SMR : 18.72 (Bearish : New series has started with the Bears in control, though near the best possible support range of 8600-8500, resistance at 9000...)