The Index opened flat above 8000 but saw selling pressure to the lows around 7950 where buying interest was seen. The index went on to make a high at 8043 but late sell-off saw the index close weak at 7971.30, loss of 30.65 points. The broader market was also weak, with 668 advances to 837 declines. The broader range for the series stays at 7800-8500.

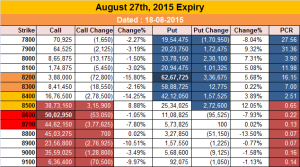

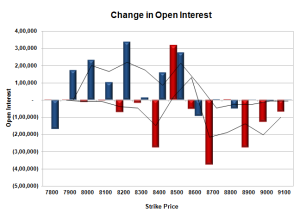

- Call option 8000-8200, 8400-8600 added huge 13.86 lacs OI with small profit booking seen at 8300 strike price.

- Put option 8000-7300 added huge 28.19 lacs OI with small short covering seen at 8100 and above strike prices.

- Nifty Open Interest is at 2,21,12,225 up by 1,25,850, with decrease in price, most probably short build-up.

- Bank Nifty Open Interest is at 19,41,750 down by 23,425, with decrease in price, most probably long liquidation.

- FII’s bought 5.57 lacs Futures, which includes 28778 contracts long build-up and 6503 contracts short build-up, with increase in net OI by 35281 contracts (includes 131652 longs to 109377 shorts for the day) and the Average Price comes to 7857.15.

- FII’s Index future open contract as on date is 651930 Longs to 264970 Shorts, Net Long 386960 up by 22275 contracts.

- Initial support stays at 8000, with OI of 48.16 lacs and below that at 7800 with OI of 45.77 lacs.

- Initial resistance at 8100, with OI of 25.14 lacs and above that at 8200 with OI of 29.59 lacs.

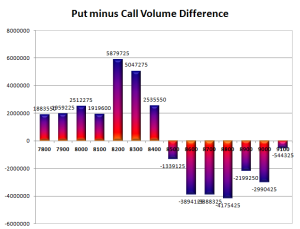

- Day Range as per Option Table is 7867 - 8105 and as per VIX is 7869 - 8074 with 7988 as the Pivot.

Call OI : 32553775

Put OI : 37473850

PCR OI : 1.151

SMR : 21.37 (Bearish with Caution : Though the index closed in RED, the OI table stayed positive with best support staying around 8000, but high VIX is not letting the index settle down, stay Neutral ...)