Expiry day saw the index opening positive above 5300 level and stayed firm till end of day, with a small sell-off marring the perfect day for the Bulls. Nifty closed the day with a huge gain of 124.05 points to close at 5409.05, just above the psychological level of 5400. The broader market was also strong, with 782 advances to 498 declines. Based on Option Table, the initial range developing is 5300-5600.

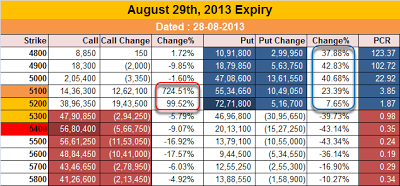

- Call option 5000-5900 added 32.29 lacs huge amount of OI.

- Put option 5400-4900 added 34.97 lacs huge amount of OI with short covering seen at 5500 strike prices.

- Nifty Open Interest is at 1,46,50,400 up by 19,41,650, with increase in price, most probably huge long build-up.

- Bank Nifty Open Interest is at 21,43,050 up by 2,51,275, with increase in price, most probably huge long build-up.

- FII’s bought 10.77 lacs Futures, mostly short covering, as their net OI decreased by 387618 (includes profit booking in shorts and some long liquidation) contracts and the average price per contract comes to around 5158.68.

- FII’s future open contract as on date is 347099.

- PCR Open Interest (Volume) at start of series is healthy 1.382.

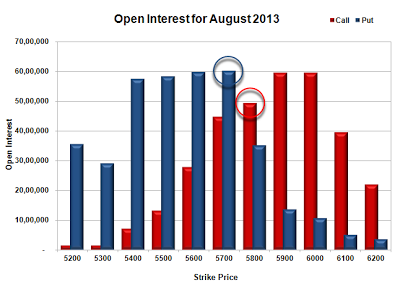

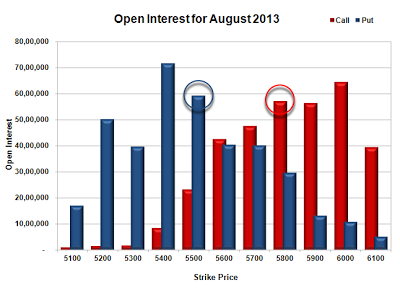

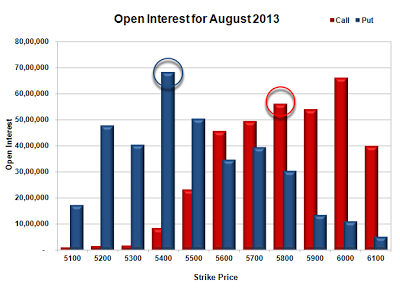

- Best Support developing at 5300, with highest OI of 45.28 lacs, and below that at 5200 with huge OI of 36.52 lacs.

- Resistance at 5600, with OI of 26.51 lacs and above that at 5700 with OI of 25.10 lacs.

- Day Range as per Option Table is 5284 - 5494 and as per VIX is 5326 - 5492 with 5380 as the Pivot.

Buy Nifty 5500CE above 111 for targets of 135, 159 SL - 95

Buy Nifty 5300PE above 135 for targets of 157, 186 SL - 129

India VIX : 29.41 down by 2.97 points

Call OI : 24067850

Put OI : 33253300

PCR OI : 1.382

SMR : 21.29 (Neutral: Bulls had a better than expected expiry with the index closing above 5400 and Option Interest for the new series right now in their favour with highest OI at 5300PE...)