Nifty opened flat to negative but was sold-off within the first hour of trade to the lows of the day at 5676. The responsive buyer took control from thereon to cover much of the lost ground but closed just in the red at 5742, a small loss of 13.05 points. The broader market was weak, with just 401 advances to 781 declines. OI Table support got better at 5700 level.

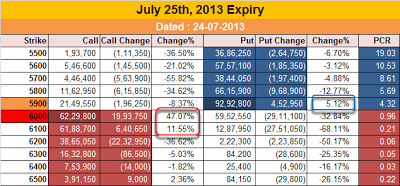

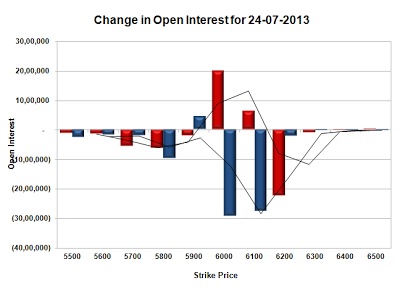

- Call option 5600-5800, 6000-6100 added 18.11 lacs huge amount OI with profit booking seen at 6200 and above strike prices.

- Put option 5700-5600, 5400 added 18.32 lacs huge amount of OI with short covering seen at 5800 and above strike prices.

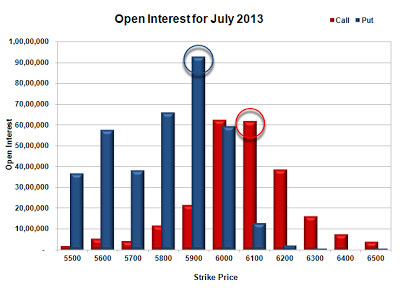

- Highest accumulation on Call option 6000 at 59.14 lacs & 6100 at 40.53 lacs whereas Put option 5700 at 59.38 lacs & 5600 at 40.78 lacs.

- Nifty Open Interest is at 1,67,02,450 down by 6,51,650, with decrease in price, most probably huge long liquidation.

- Bank Nifty Open Interest is at 22,11,375, up by 51,700, with huge decrease in price, most probably huge short build-up.

- FII’s sold 19.93 lacs Futures, mostly long liquidation, as their net OI decreased by 5261 contracts and the average price per contract comes to around 5656.38.

- FII’s future open contract as on date is 400569.

- PCR Open Interest (Volume) has moved up to 1.083 due to huge addition at lower level PE’s.

- Support got better at 5700, with highest OI of 59.38 lacs and below that at 5600 with OI of 40.78 lacs.

- Initial resistance at 5800, with huge addition for the day at 3.13 lacs and above that at 6000 with huge OI of 59.14 lacs.

- Day Range as per Option Table is 5669 - 5790 and as per VIX is 5686 - 5798 with 5723 as the Pivot.

Buy Nifty 5800CE above 105 for targets of 117, 131 SL - 96

Buy Nifty 5700PE above 90 for targets of 101, 120 SL - 85

India VIX : 18.77, up by 0.65 points

Call OI : 29122850

Put OI : 31531400

PCR OI : 1.083

SMR : 17.34 (Bearish: Nifty for the first time in many days made a huge pull back from the lows to close just a few points in the negative. Can the Bulls take control from here or the Bears will be back for the kill, tomorrow could be the day of reckoning...)