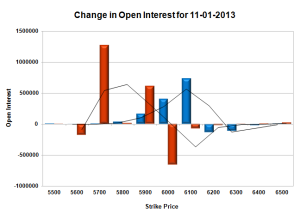

A gap-up opening on the back of better than expected Infy quarterly results, saw the index getting sold-off to the lows of the day around 5940, with no buying seen whatsoever. Nifty closed around the lows of the day at 5951.30 a small loss of 17.35 points. On a week-on-week basis the index lost 64.85 points or about 1.08%. The broader market performed dismally, with just 361 advances to 1160 declines. The OI Table saw huge addition at 6100CE and 5700PE levels.

- Call option 5900-6100 added 12.97 lacs huge amount of OI with huge profit booking seen at 6200 and above strike prices.

- Put Option 5900-5700 added 18.96 lacs huge amount of OI with short covering seen at 6000 and above strike prices.

- Highest accumulation on Call option 6200 at 78.7 lacs & 6100 at 69.8 lacs whereas Put option 5700 at 78.8 lacs & 5800 at 76.2 lacs.

- Nifty Open Interest is at 1,57,08,200 down by 4,06,450, with decrease in price, most probably huge long liquidation.

- Bank Nifty Open Interest is at 10,81,825 down by 74,300, with huge decrease in price, most probably huge long liquidation.

- FII’s bought 2.83 lacs of Futures, most probably short covering, as their net OI decreased by 3216 contract and the average price per contract comes to around 5984.

- FII’s future open contract as on date is 262599.

- PCR Open Interest (Volume) is still at a good level at 1.252.

- Support still at 5900PE with OI now above 74.1 lacs and below that at 5800 with OI of 76.2 lacs.

- Initial Resistance now at 6000CE, with OI above 53.8 lacs, and above that at 6100 with huge OI of 69.8 lacs.

- Range as per Option Table is 5925 - 6007 and as per VIX is 5910 - 5993 with 5970 as the Pivot.

Buy Nifty 6000CE above 64 for targets of 76, 98 SL - 60

Buy Nifty 6000PE above 77 for targets of 88, 100 SL - 69

India VIX : 13.23 down by 0.04

Call OI : 34629450

Put OI : 43370650

PCR OI : 1.252

SMR : 10.56 (Bearish to Neutral: Bears are back in business, with huge selling seen at higher levels, now Bulls need to hold fort or else Bears will start dominating the OI Table...)

No comments:

Post a Comment