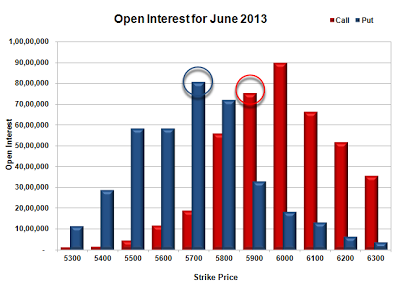

Nifty opened weak, and went on to touch the lows of the day around 5780 within the first hour itself, but saw the responsive buyer coming back to move the index above positive territory to close around the highs of the day at 5822.25, a very small gain of 8.65 points. The broader market was also positive, with 687 advances to 585 declines. Option Table range has come down to 5700-5900 with 5800 acting as Pivot.

- Call option 5900-6100 added just 5.89 lacs of OI with huge short covering seen at 5800 and below strike prices.

- Put option 5800-5500 added 16.51 lacs huge amount of OI with short covering seen at 5900 and above strike prices.

- Highest accumulation on Call option 6000 at 89.99 lacs & 5900 at 75.19 lacs whereas Put option 5700 at 80.60 lacs & 5800 at 72.12 lacs.

- Nifty Open Interest is at 1,85,34,150 up by 7,34,850, with not much change in price, most probably huge short build-up.

- Bank Nifty Open Interest is at 13,29,975, down by 3,250, with increase in price, most probably small short covering.

- FII’s sold 6.20 lacs Futures, most probably short build-up, as their net OI increased by 14688 contracts and the average price per contract comes to around 5834.

- FII’s future open contract as on date is 436015.

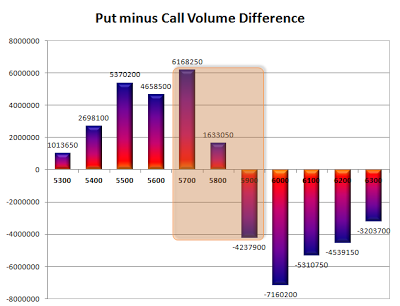

- PCR Open Interest (Volume) is still in danger zone at 0.907.

- Initial support at 5800, with OI now above 72.12 lacs and below that at 5700 with huge OI of 80.60 lacs.

- Super resistance right now at 5900, with huge OI of 75.19 lacs and above that at 6000 with highest OI of 89.99 lacs.

- Range as per Option Table is 5754 - 5871 and as per VIX is 5766 - 5879 with 5830 as the Pivot.

Buy Nifty 5800CE above 77 for targets of 86, 96 SL - 70

Buy Nifty 5800PE above 64 for targets of 74, 91 SL - 59

India VIX : 18.46, up by 0.17 points

Call OI : 48079450

Put OI : 43593600

PCR OI : 0.907

SMR : 19.68 (Neutral: Status Quo has been maintained with neither party in a mood to take big risk with FOMC lurking for the day, though a range of 5700-5900 has been established with 5800 as pivot...)

No comments:

Post a Comment