Nifty opened weak due to RBI action yesterday evening of lowering the amount banks can borrow under its daily liquidity window. Bank Nifty was the biggest loser tanking 4.6% the highest in recent times. The index went on to touch the lows around 5960 but settled at 5990.50, still a huge loss of 87.30 points, closing below the psychological level of 6000. The broader market was also negative, with just 235 advances to 951 declines. Expiry could be just below 6000 based on OI table.

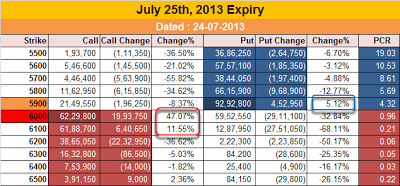

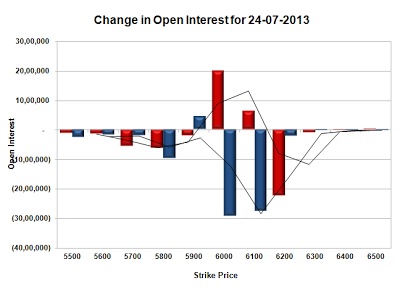

- Call option 6000-6100 added 26.34 lacs huge amount OI with profit booking seen at 6200 and above strike prices.

- Put option 5900 added 4.53 lacs huge amount of OI with huge short covering seen at 6000 and above strike prices.

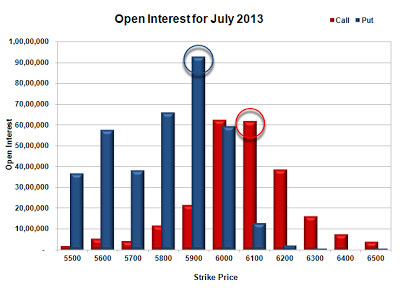

- Highest accumulation on Call option 6000 at 62.30 lacs & 6100 at 61.89 lacs whereas Put option 5900 at 92.93 lacs & 5800 at 66.16 lacs.

- Nifty Open Interest is at 93,78,800 down by 24,89,450, whereas August series added 31.71 lacs, with huge decrease in price, most probably 100% rollover with huge short build-up in next series.

- Bank Nifty Open Interest is at 15,96,800, down by 66,350, whereas August series added 4.18 lacs, with huge decrease in price, most probably 100% rollover with huge short build-up in next series.

- FII’s bought huge 7.71 lacs Futures, mostly probably long build-up, as their net OI increased by 21702 contracts and the average price per contract comes to around 5903.36.

- FII’s future open contract as on date is 647712.

- PCR Open Interest (Volume) has crashed down to 1.790.

- Support shifting down to 5900, with highest OI of 92.93 lacs and below that at 5800 with OI of 66.16 lacs.

- Initial Resistance at 6000, with OI above 62.30 lacs and above that at 6100 with OI of 61.89 lacs.

- Expiry Range as per Option Table is 5938 - 6057 and as per VIX is 5937 - 6044 with 6000 as the Pivot.

Buy Nifty 6000CE above 36 for targets of 49, 75 SL - 29

Buy Nifty 6000PE above 27 for targets of 44, 65 SL - 19

India VIX : 16.91 up by 0.19 points

Call OI : 24575000

Put OI : 43986600

PCR OI : 1.790

SMR : 9.45 (Bearish: The RBI governor made it easy for the Bears to make a comeback on the eve of expiry to capture 6000 level any making sure that expiry happens around 6000 or just below it...)

No comments:

Post a Comment