Inference

Nifty opened flat to positive, and stayed positive for the entire session making a high around 6270 but closed just below at 6251.70, still a gain of 30.80 points. The broader market was just positive, with 713 advances to 633 declines. As per OI table the range for expiry tomorrow comes around 6200-6300.

Buy Nifty 6200CE above 64 for targets of 80, 100 SL - 59

Buy Nifty 6300PE above 61 for targets of 79, 100 SL - 55

India VIX : 19.53, down by 0.23 points

Call OI : 29955050

Put OI : 51915800

PCR OI : 1.733

SMR : 11.27 (Bullish: Bulls are on a roll with no let up seen today; expiry tomorrow can see a new high for the year and all-time highest monthly closing, stay with trend but be cautions at higher levels...)

Nifty opened flat to positive, and stayed positive for the entire session making a high around 6270 but closed just below at 6251.70, still a gain of 30.80 points. The broader market was just positive, with 713 advances to 633 declines. As per OI table the range for expiry tomorrow comes around 6200-6300.

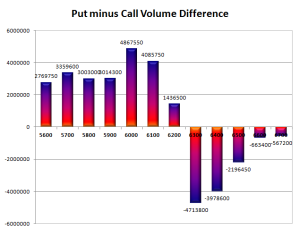

- Call option 6400 added 6.08 lacs huge amount of OI with huge short covering seen at 6300 and lower strike prices.

- Put option 6400-6200 added 8.31 lacs huge amount of OI with profit booking seen at 6100 and lower strike prices.

- Nifty Open Interest is at 1,09,50,750 down by 18,72,750, whereas Nov Series added huge 27.02 lacs OI, with increase in price, most probably 100% roll-over with huge long build-up.

- Bank Nifty Open Interest is at 12,16,975 down by 3,85,600, whereas Nov Series added 3.86 lacs with small increase in price, most probably 100% roll-over.

- FII’s bought huge 3.00 lacs Futures, mostly long build-up, as their net OI increased by 27987 contracts (includes 160367 longs and 154366 shorts) and the average price per contract comes to around 6201.22.

- FII’s future open contract as on date is 669258.

- PCR Open Interest (Volume) is at 1.733.

- Support right now at 6200, with huge OI of 46.51 lacs, below that at 6100, with huge OI of 60.18 lacs.

- Best Resistance still at 6300, with OI of 58.39 lacs.

- Day Range as per Option Table is 6187 - 6314 and as per VIX is 6188 - 6316 with 6248 as the Pivot.

Sneak Peek at Next Months Option Table

Option Call for 31-10-2013Buy Nifty 6200CE above 64 for targets of 80, 100 SL - 59

Buy Nifty 6300PE above 61 for targets of 79, 100 SL - 55

India VIX : 19.53, down by 0.23 points

Call OI : 29955050

Put OI : 51915800

PCR OI : 1.733

SMR : 11.27 (Bullish: Bulls are on a roll with no let up seen today; expiry tomorrow can see a new high for the year and all-time highest monthly closing, stay with trend but be cautions at higher levels...)

No comments:

Post a Comment