Nifty opened flat to positive, but saw the Sellers taking control from the word go and had a perfect trend day closing at the lowest point at 6001.10, a huge loss of 82.90 points. The broader market was also very weak, with just 392 advances to 1031 declines. Best support for the Series still at 6000PE with OI now around 95 lacs.

- Call option 5900-6100 added 19.10 lacs huge amount of OI with profit booking seen at 6400 and above strike prices.

- Put option 6000, 5800-5600 added 8.18 lacs huge amount of OI with short covering seen at 6100 and above strike prices.

- Nifty Open Interest is at 1,66,56,500 up by 11,30,150, with decrease in price, most probably huge short build-up.

- Bank Nifty Open Interest is at 17,44,150 up by 13,000, with decrease in price, most probably short build-up.

- FII’s sold huge 3.42 lacs Futures, mostly short build-up, as their net OI increased by 13752 contracts (includes 38526 longs and 45366 shorts for the day) and the average price per contract comes to around 5925.66.

- FII’s future open contract as on date is 385814.

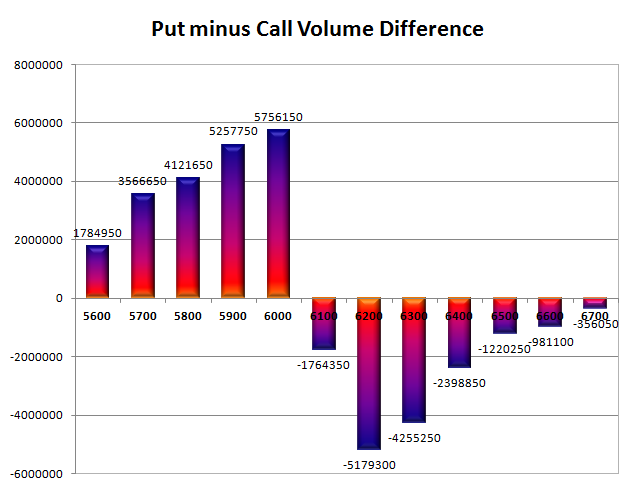

- PCR Open Interest (Volume) has dropped to 1.202.

- Best support still at 6000, with highest OI of 94.96 lacs and below that at 5900 with huge OI of 62.37 lacs.

- Initial resistance getting better at 6100, with huge OI of 56.22 lacs and above that at 6200, with OI of 66.41 lacs.

- Day Range as per Option Table is 5975 - 6070 and as per VIX is 5945 - 6057 with 6029 as the Pivot.

Buy Nifty 6000CE above 98 for targets of 119, 140 SL - 92

Buy Nifty 6000PE above 75 for targets of 91, 107 SL - 64

India VIX : 17.80 up by 0.37 points

Call OI : 35488650

Put OI : 42663800

PCR OI : 1.202

SMR : 14.81 (Bearish: The Index closed at the lowest point of the range and looks vulnerable to break the super support of 6000, but the PE OI is highest at 94.96 lacs...)

No comments:

Post a Comment