The index opened weak on the back of bad global cues but saw the responsive buyer take control to move the index above 8100 and then closing positive at 8146.30, a small gain of 24.85 points. The broader market was just positive, with 818 advances to 743 declines. The range for the series is at 8000-8200.

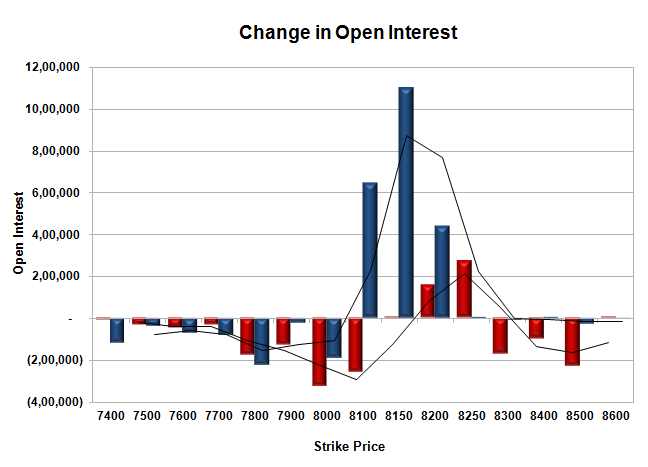

- Call option 8200-8250 added huge 4.31 lacs OI with huge short covering seen at 8100 and below strike prices.

- Put option 8200-8100 added huge 21.87 lacs OI with profit booking seen at 8000 and below strike prices.

- Nifty Open Interest is at 1,10,90,150 down by 16,57,450, whereas Oct series added 39.02 lacs with increase in price, probably 100% rollover with huge long build-up.

- Bank Nifty Open Interest is at 15,08,725 down by 63,100, whereas Oct series added 2.01 lacs with increase in price, probably 100% rollover with huge long build-up.

- FII’s bought 1.76 lacs Futures, which includes 45058 contracts long build-up and 41536 contracts short build-up, with increase in net OI by 85694 contracts (includes 134866 longs to 131344 shorts for the day) and the average price per contract comes to around 8172.02.

- FII’s Index future open contract as on date is 229116 Longs to 118400 Shorts, net long 110716 contracts.

- Initial support at 8100, with huge OI of 60.28 lacs and below that at 8000 with highest OI of 82.37 lacs.

- Initial and best resistance still at 8200, with huge OI of 76.80 lacs and above that at 8300 with huge OI of 55.63 lacs.

- Day Range as per Option Table is 8068 - 8189 and as per VIX is 8097 - 8196 with 8124 as the Pivot.

Buy Nifty 8100CE above 71 for targets of 95, 118 SL - 59

Buy Nifty 8200PE above 77 for targets of 97, 126 SL - 69

India VIX : 11.57 down by 0.32 points

Call OI : 34864450

Put OI : 42845550

PCR OI : 1.229

SMR : 9.41 (Bullish: The Index opened weak but saw the Bulls coming back with huge addition at 8200-8100PE level with 8100 now a very good support, Higher level resistance still at 8200...)

No comments:

Post a Comment