The Index opened positive above 8500 and went on to make the high of the day within the first few minutes of trade but saw huge un-winding to the lows at 8434 but closed a bit higher at 8466.55, loss of 10.75 points. The broader market though was positive, with 884 advances to 631 declines. The broader range expanded to 8200-8800.

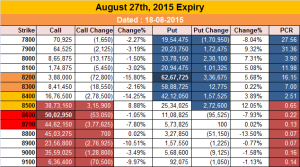

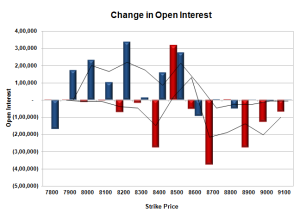

- Call option 8500 added 3.16 lacs OI with profit booking seen at 8900 and above strike prices.

- Put option 8500-7900 added huge 12.83 lacs OI with short covering seen at 8600 and above strike prices.

- Nifty Open Interest is at 1,42,53,925 down by 2,41,800, with decrease in price, most probably huge long liquidation.

- Bank Nifty Open Interest is at 19,99,750 down by 1,01,050, with decrease in price, most probably huge long liquidation.

- FII’s bought 0.53 lacs Futures, which includes 2644 contracts long liquidation and 4747 contracts short covering, with decrease in net OI by 7391 contracts (includes 54674 longs to 52571 shorts for the day) and the Average Price comes to 9020.92.

- FII’s Index future open contract as on date is 421582 Longs to 171238 Shorts, Net Long 250344 up by 2103 contracts.

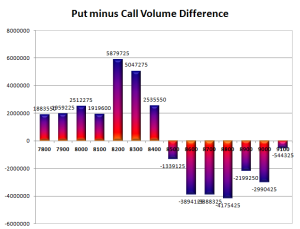

- Initial support still at 8400, with OI of 42.12 lacs and below that at 8300 with huge OI of 58.89 lacs.

- Initial resistance stays at 8500, with OI of 38.73 lacs and above that at 8600 with OI of 50.03 lacs.

- Day Range as per Option Table is 8399 - 8548 and as per VIX is 8394 - 8539 with 8475 as the Pivot.

Call OI : 33899525

Put OI : 36699300

PCR OI : 1.083

SMR : 15.11 (Bullish to Neutral: The index though closed in red but the OI table stayed positive with huge support around 8400-8200 level, resistance around 8600...)

No comments:

Post a Comment