The index opened huge gap-up and stayed positive to close at 8867.45, huge gain of 90.30 points. The broader market was strong with 1079 advances to 536 declines. Range stays at 8600-9000.

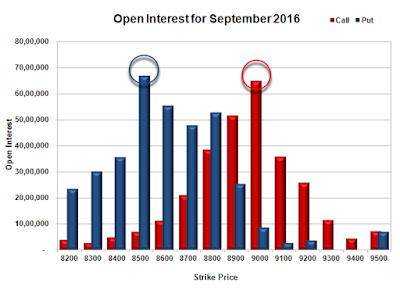

- Call option 9000 added 1.76 lacs OI with short covering at 8800 and below strike prices.

- Put option 8900-8900 added 11.96 lacs OI with profit booking at 8700 and below strike prices.

- Nifty Open Interest is at 3,22,29,750 down by 1,94,775, with increase in price, probably short covering.

- Bank Nifty Open Interest is at 21,27,480 down by 18,640, with increase in price, probably short covering.

- FII’s sold 3512 contracts of Index Futures, which includes net 2694 contracts long liquidation and 818 contracts short build-up, with decrease in net OI by 1876 contracts, includes 45172 longs to 48684 shorts for the day.

- FII’s Index future open contract as on date is 400293 Longs to 75087 Shorts, Net long 325206 contracts.

- Initial support at 8800, with OI of 52.80 lacs and below that at 8700 with OI of 47.77 lacs.

- Initial resistance at 8900, with OI of 51.70 lacs and above that at 9000 with OI of 65.03 lacs.

- Day Range as per Option Table is 8807 - 8926 and as per VIX is 8806 - 8929 with 8866 as the Pivot.

Call OI : 38352525

Put OI : 51442950

PCR OI : 1.3413

SMR : 9.95 (Bullish : Great day for the Bulls, but need a follow up action on Friday for an expiry around 9000, or else the rally may fizzle out for an expiry near the lower range...)

No comments:

Post a Comment