The Index opened flat to positive, but saw huge selling from the morning itself to close near the lows of the day at 8044.15, huge loss of 70.55 points. The broader market was also negative, with 347 advances to 1133 declines. The broader range as per Option Table stays at 8000-8500.

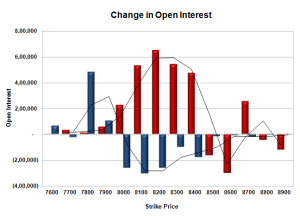

- Call option 8000-8400 added huge 24.22 lacs OI with profit booking seen at 8500 and above strike prices.

- Put option 7900-7800 added huge 5.87 lacs OI with short covering seen at 8000 and above strike prices.

- Nifty Open Interest is at 1,62,46,550 down by 88,200, with decrease in price, most probably long liquidation.

- Bank Nifty Open Interest is at 23,75,950 up by 16,225, with decrease in price, most probably short build-up.

- FII’s sold 3.17 lacs Futures, which includes 17676 contracts long liquidation and 4992 contracts short covering, with decrease in net OI by 22668 contracts (includes 71939 longs to 84623 shorts for the day) and the Average Price comes to 8314.97.

- FII’s Index future open contract as on date is 333987 Longs to 328489 Shorts, Net Short 12684 contracts.

- Initial and best support at 8000, with huge OI of 47.36 lacs and below that at 7900 with OI of 37.81 lacs.

- Initial resistance at 8200, with OI of 32.18 lacs and above that at 8300 with OI of 40.73 lacs.

- Day Range as per Option Table is 7984 - 8146 and as per VIX is 7965 - 8124 with 8069 as the Pivot.

Call OI : 42893975

Put OI : 36086375

PCR OI : 0.841

SMR : 22.39 (Bearish with Caution: The OI Table has turned very weak with only and best support at 8000, minefield of resistances starts from 8200, Sell on Rise...)

No comments:

Post a Comment