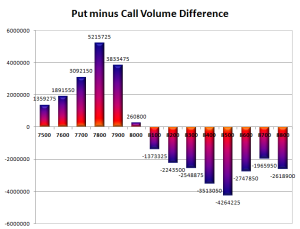

The Index opened flat and stayed in a narrow oscillating between red and green to close just a bit up at 7982.90, small gain of 17.55 points. The broader market though was weak, with 601 advances to 871 declines. The broader range as per Option Table stays at 7800-8500.

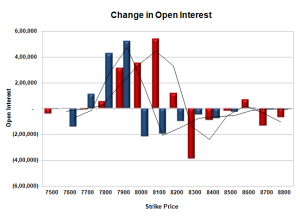

- Call option 7900-8200 added huge 13.26 lacs OI with profit booking seen at 8300 and above strike prices.

- Put option 7900-7700 added huge 10.62 lacs OI with short covering seen at 8000 and above strike prices.

- Nifty Open Interest is at 1,66,57,725 up by 66,950, with increase in price, most probably small long build-up.

- Bank Nifty Open Interest is at 26,18,100 up by 1,15,025, with increase in price, most probably huge long build-up.

- FII’s sold 2.64 lacs Futures, which includes 16099 contracts long build-up and 26645 contracts short build-up, with increase in net OI by 42744 contracts (includes 67053 longs to 77599 shorts for the day) and the Average Price comes to 8462.85.

- FII’s Index future open contract as on date is 369062 Longs to 362225 Shorts, Net Long 6837 contracts.

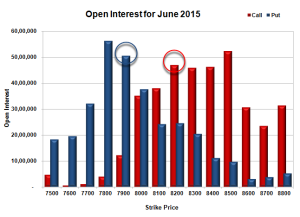

- Initial and good support at 7900, with OI of 50.53 lacs and below that at 7800 with highest OI of 56.23 lacs.

- Initial resistance at 8000, with OI of 35.11 lacs and above that at 8100 with OI of 37.93 lacs.

- Day Range as per Option Table is 7897 - 8057 and as per VIX is 7910 - 8056 with 7973 as the Pivot.

Call OI : 49998425

Put OI : 39462375

PCR OI : 0.789

SMR : 22.15 (Bearish with Caution: The OI Table stays weak with huge resistance starting from 8200 level, the best support comes around 7900-7800 level, and the index may stay within this range for the coming week...)

No comments:

Post a Comment