Inference

Nifty opened flat just above the previous day’s close but saw buying interest in the initial stages to be sold off during the mid session and closing with a flurry at 5742.30, a good gain of 43.00 points. Nifty in the last 4 trading session has covered more than 40 % of the fall from 6093 to 5487. The broader market was just positive, with 673 advances to 513 declines. Highest addition for the day was at 5700PE, which looks more like buying than selling.

Buy Nifty 5700CE above 104 for targets of 117, 131 SL - 97

Buy Nifty 5800PE above 112 for targets of 127, 152 SL - 106

India VIX : 18.70 down by 0.56 points

Call OI : 37642250

Put OI : 41424750

PCR OI : 1.100

SMR : 16.99 (Neutral to Bullish: Bulls are gaining strength with each passing day and now looks well set to hold 5600 level for the time being but need to stay alert as they are still way down from the immediate top of 6093...)

Nifty opened flat just above the previous day’s close but saw buying interest in the initial stages to be sold off during the mid session and closing with a flurry at 5742.30, a good gain of 43.00 points. Nifty in the last 4 trading session has covered more than 40 % of the fall from 6093 to 5487. The broader market was just positive, with 673 advances to 513 declines. Highest addition for the day was at 5700PE, which looks more like buying than selling.

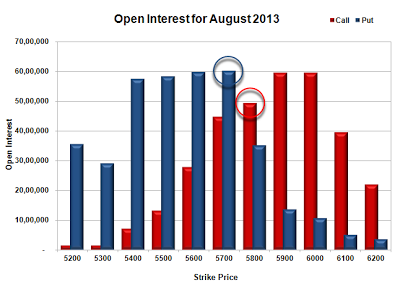

- Call option 6100 added 0.88 lacs OI with short covering seen at 5700 and below strike prices.

- Put option 5900-5600 added 27.57 lacs huge amount of OI with profit booking seen at 5400 and below strike prices.

- Highest accumulation on Call option 6000 at 59.51 lacs & 5900 at 59.48 lacs whereas Put option 5700 at 60.25 lacs & 5600 at 59.76 lacs.

- Nifty Open Interest is at 1,49,04,500 up by 11,19,250, with increase in price, most probably huge long build-up.

- Bank Nifty Open Interest is at 24,17,050 down by 8,600, no change in price, most probably small short covering.

- FII’s sold 12.09 lacs Futures, mostly short build-up, as their net OI increased by 24379 contracts and the average price per contract comes to around 5605.32.

- FII’s future open contract as on date is 411250.

- PCR Open Interest (Volume) is stable at 1.100.

- Support now up at 5700, with huge OI addition for the day at 14.55 lacs and highest OI of 60.25 lacs, below that at 5600 with OI of 59.76 lacs.

- Initial resistance still at 5800, with OI of just 49.28 lacs and above that at 5900 with huge OI of 59.48 lacs.

- Day Range as per Option Table is 5665 - 5799 and as per VIX is 5686 - 5799 with 5729 as the Pivot.

Buy Nifty 5700CE above 104 for targets of 117, 131 SL - 97

Buy Nifty 5800PE above 112 for targets of 127, 152 SL - 106

India VIX : 18.70 down by 0.56 points

Call OI : 37642250

Put OI : 41424750

PCR OI : 1.100

SMR : 16.99 (Neutral to Bullish: Bulls are gaining strength with each passing day and now looks well set to hold 5600 level for the time being but need to stay alert as they are still way down from the immediate top of 6093...)

No comments:

Post a Comment