Nifty opened flat and saw the buyers back after many days of hiatus to move the index higher with each passing hour to end near the highs of the day at 5565.65, a good gain of 46.55 points. On a week on week basis the index though lost 112.25 point or around 1.98%. The broader market was positive, with 824 advances to 346 declines. Overhead resistance is getting stronger at 5700 level.

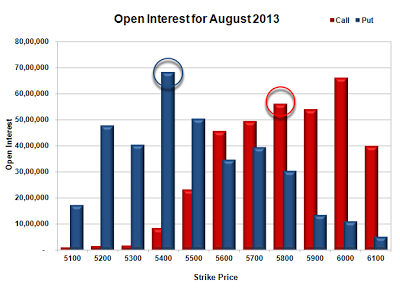

- Call option 5500-5700 added 18.38 lacs huge amount OI with profit booking seen at 5800 and above strike prices.

- Put option 5500, 5300-5200 added 7.84 lacs huge amount of OI with short covering seen at 5700 and above strike prices.

- Highest accumulation on Call option 6000 at 66.16 lacs & 5800 at 56.09 lacs whereas Put option 5400 at 68.21 lacs & 5500 at 50.55 lacs.

- Nifty Open Interest is at 1,58,34,950 up by 2,66,550, with increase in price, most probably long build-up.

- Bank Nifty Open Interest is at 23,63,175, down by 36,900, with increase in price, most probably huge short covering.

- FII’s bought 7.36 lacs Futures, mostly long build-up, as their net OI increased by 4731 contracts and the average price per contract comes to around 5456.85.

- FII’s future open contract as on date is 414060.

- PCR Open Interest (Volume) is still below 1 at 0.934.

- Initial support at 5500, with OI of 50.55 lacs, and below that at 5400 with highest OI of 68.21 lacs.

- Initial resistance at 5600, with OI of 45.63 lacs and above that at 5700 with OI of 49.48 lacs.

- Day Range as per Option Table is 5489 - 5622 and as per VIX is 5504 - 5627 with 5522 as the Pivot.

Buy Nifty 5600CE above 96 for targets of 106, 117 SL - 90

Buy Nifty 5500PE above 76 for targets of 86, 105 SL - 70

India VIX : 21.19, down by 0.85 points

Call OI : 42417050

Put OI : 39611750

PCR OI : 0.934

SMR : 22.69 (Bearish: The Bulls after many days came back to save the psychological level of 5500 but need to carry on the good work or else Bears will be back with force...)

No comments:

Post a Comment